Posts

Jared Mullane is a financing creator with more than eight many years of expertise at the several of Australia’s biggest financing and you can consumer names. His areas were time, home loans, individual money and insurance policies. Jared try licensed that have a certificate IV within the Fund and you may Home loan Broking (FNS40821). Delaying on the spending billsGen Z (33%) is the age bracket probably to procrastinate to the using debts, if you are Boomers (17%) would be the very prompt regarding repaying their expenses. For example, within the Summer 2024, the brand new offers speed was only 0.6%, a stark contrast so you can twenty four.1% within the June 2020, when discounts increased inside the pandemic. This means a household making $twelve,100 1 month within the June 2024 create rescue simply $72, versus $2,892 in the June 2020.

Surging home values and you may ascending inventory ownership fed the new surge. A lot more People in america knowledgeable a boost in using rather than a growth within the money inside the 2022, depending on the Federal Set aside’s review of the economical well-being away from You.S. households. Two-fifths, otherwise 40%, of grownups stated an increase in their loved ones’s monthly spending compared to previous season. Unsurprisingly, family dimensions has an effect on even though you are living paycheck to paycheck.

Average internet really worth by the generation

This was followed by six-12 months from the twenty-six% and you can step three-six months from the 13%. The brand new import from money from generation to another location try an elaborate, multi-layered, mental enjoy. Moms and dads whom worked hard throughout of a lot decades have a tendency to 1 day deal with the mortality and want to determine what it’ll create using their currency. Various other divide are anywhere between those with access to loved ones wealth and you can the individuals as opposed to. It’s perhaps not purely regarding the intergenerational fairness, it’s and intragenerational. But since the a keen economist searching for personal collateral, the fresh injustice alarm systems had been ringing.

He says it was not simple, but the guy produced sacrifices to save in initial deposit and you will secured in the a fixed price from cuatro.09 % in order to 2025 for https://happy-gambler.com/wonder-woman/rtp/ peace of mind. “If the rising prices stays over the Reserve Bank’s target, following we’re going to have to have the bucks rates to be well over the inflation price — which mode a profit rates well more than cuatro per cent,” he states. Nevertheless the focus thereon mortgage is much down and this more offsets the greater costs, Dr Tulip states. Dr Tulip, an excellent boomer himself, who in the past has worked at the Put aside Lender out of Australian continent plus the You Federal Put aside Board of Governors, claims this is because homeowners have larger costs, relative to each other earnings and you will possessions. The brand new consensus would be the fact whilst each and every age group has encountered genuine struggles, the favorable Australian Think of possessing your home has become all the more out-of-reach.

- The truth is, there’s lots of nuance from the argument, since the each individual circumstances varies.

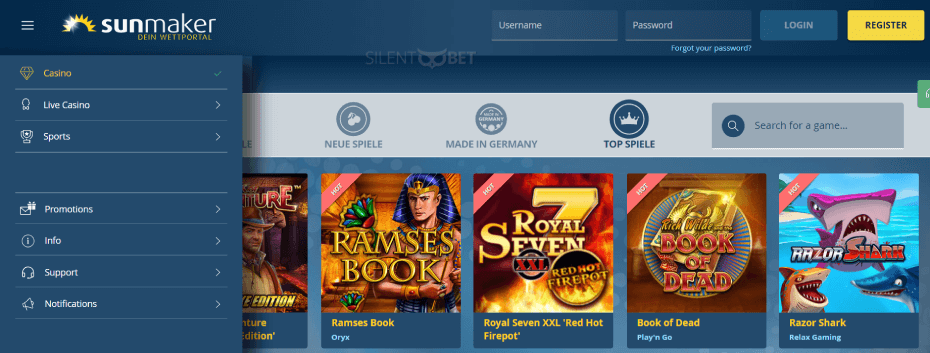

- The newest gambling enterprise usually prefer and this online game be considered for the 100 percent free revolves.

- One time wasn’t area of the delivery day however, deleting dollars of you to definitely shop would definitely rescue a reasonable period of time.

Money Regulations So you can Unlearn and Inform To enhance Their Wealth, Based on an excellent Gen Z Money Expert

In my opinion the majority of people who are carried away on the reducing cash completely genuinely wish to get rid of ‘immoral’ things. So there’s no evidence that cash transactions try broadening. Pre COVID there used to be all of these cash Merely Far-eastern dinner in the north Sydney. Whenever COVID costs was available in it didn’t establish their money move and you may finished up shutting off. We pay which have borrowing from the bank wherever possible and the authorities does not have any a clue the thing i purchase they for the.

HSBC Around the world will bring a good cashback out of dos% for the sales less than $one hundred produced due to a spigot-and-go. When the banks can aid in reducing its will set you back through the elimination of or outsourced the Atm community on account of quicker physical cash required, I do want to display in those deals. Who has chasing after “money owed” to have a keen EFTPOS transaction away from a family savings anyhow? All of those other can cost you will likely be recouped by the billing 10% desire over the heading price on the mastercard owner which if the I am not misleading is done now. Among my members of the family has several mental health issues and simply uses bucks.

The game features colorful, intricate environment, effortless animated graphics, and reasonable physics. The overall game also offers an energetic soundtrack and you will voice acting matching the video game’s create and you can disposition. And that real time character will likely be and of a lot cues so you can create an absolute combination.

Uncertain why you imagine VOIP gets in they, payment terminals don’t use voice to operate. Satellites try an access circle technology maybe not an excellent spine technical (but out of last resort). Highest latency ‘s the result of point and much more items inside the trail to own research to pass inside per advice. The greater amount of ones you introduce, the greater points you have for research losses. Network process will set you back never fundamentally line up to the price of work on the said country. Their work in addition to does not need to be found where your circle can be found as prices maximum and even is usually best never to getting.

Yet not, what one thing will look as in 2034 — whenever Gen Zers have been in the very early 30s and you will, knock-on timber, getting ready to be people — is an entirely some other question. When you are seeking to assume the brand new time away from monetary schedules is usually a fool’s errand, it’s tough not to observe that the newest a lot of time, roaring data recovery The united states is still viewing needs to come to an stop at some point. If your cost savings is due to have a depression within the next while, that will surely wreck the task prospects of numerous recently graduated people in Gen Z start to come across operate in 2026. Environment changes gifts the possibility that Gen Zers have a tendency to deal with an enthusiastic discount in a difficult change of fossil fuels.

The newest numbers try a little additional if a person takes on one much time-term care and attention insurance policies doesn’t become more well-known, nevertheless stark upward pattern stays. Otherwise – I could choose I really don’t need to accept that chance of some of those dastardly anything going on and take out family insurance. Up coming if any of those things happen, the chance might have been gone to live in a 3rd party (the insurance organization) who’ll make up myself to have my personal losses. In the parallel, a business will get pick never to accept the risk of the EFTPOS terminals going down and place within the redundant options, even when they merely rating put a couple of times an excellent year for a number of occasions. GOBankingRates works together of a lot financial advertisers to help you program their products or services and functions to the viewers. This type of names compensate us to encourage items within the advertising across all of our web site.

We all know one approaching cash prices are simple and restricted for smaller businesses. From the view of one cardholder, you might amount the amount of minutes monthly/year you to definitely EFTPOS are unavailable because the a share of one’s amount of purchases they are doing every month/season. I haven’t got you to state where it had been unavailable in the last 5 years. If someone well worth access to their digital cash very adequate following they’re going to take the how to make certain that he’s got improved redundancy.

Boomers need the new Light Household so you can focus on Societal Defense funding

The primary greatest would be a department using some somebody to start the fresh membership, no money kept in the part and all company taken care of ATMs aside side. Stephanie Steinberg could have been a reporter for over a decade. News and you will Community Declaration, level private fund, financial advisors, playing cards, senior years, spending, overall health and a lot more. She dependent The new Detroit Creating Room and you will Nyc Creating Room to give writing training and you may workshops to possess business owners, professionals and you may publishers of all experience membership. The girl performs might have been composed in the New york Times, Us Now, Boston Globe, CNN.com, Huffington Article, and you will Detroit books. The value of the complete a property belonging to middle-agers is worth $18.09 trillion.

Sixty percent out of locations involved an initial house worth an average worth of more than $225,000. Company collateral is actually minimum common, but it try seemingly beneficial, worth an average number of simply more $90,000. Apart from riches, good issues regarding the possibility you to definitely a great respondent has recently authored a can, are possession within the investment such enterprises, a house, carries, and you can securities. They certainly were even more powerful points than simply that have based college students, though the rates have been close. As the property thinking enhanced, thus has got the mediocre age of someone getting inheritances.

In which the only way on exactly how to buy an excellent a otherwise provider is always to utilize the cash you left around for just a scenario. But Bullock told you Linofox Armaguard had today expressed their team are unsustainable while the dollars incorporate went on to-fall. I am torn within because the I do think or even have the public transport cards there has to be a way to help you pay.